north carolina estate tax exemption 2019

26 rows What is the North Carolina estate tax exemption. North Carolina Department of Revenue.

North Carolina Tax Reform North Carolina Tax Competitiveness

As of 2019 if a person who dies.

. Individual income tax refund inquiries. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. The estate tax exemption is the amount a.

2019 North Carolina General Statutes Chapter 159I - Solid Waste Management Loan Program and Local Government Special Obligation. North Carolina General Assembly. Premium Federal Tax Software.

Qualifying owners must apply with the Assessors Office between January 1st and June 1st. If you died and this was the only asset you have you would receive an estate tax exemption or coupon of 549 million leaving a taxable estate of approximately 1000000 and an estate. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax.

Up from 1118 million per individual in 2018 to 114. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. Then the estate tax rates for the top four brackets increased by one percentage point.

NC Gen Stat 159I-23 2019 159I-23. This bill will annually increase the states estate tax exemption until it matches the federal. The estate tax exemption was then increased in 200000.

The Internal Revenue Service announced today the official estate and gift tax limits for 2019. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in. This increases to 3 million in 2020 Mississippi.

First the states 2 million exemption was indexed for inflation on an annual basis. PO Box 25000 Raleigh NC 27640-0640. Department of Revenue has published the 2019 Tax Law Change book which summarizes the recent legislative changes to the states Revenue laws.

The North Carolina State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 North Carolina State Tax Calculator. The top estate tax rate is 16 percent exemption threshold. 2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption.

NCDOR Issues Update on Opening of 2022 Tax Season. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax. Streamlined Sales and Use Tax Agreement Certificate of Exemption Form.

The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. North Carolina allows low-income homestead exclusions for qualifying individuals. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent.

16 West Jones Street. NC Gen Stat 131A-21 2019 131A-21. Delaware repealed its estate tax in 2018.

Up to 25 cash back However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal. That limit is the applicable lifetime gift and estate tax. 100 Free Federal for Old Tax Returns.

The estate and gift tax exemption is 114 million per individual up from 1118. Ad Prepare your 2019 state tax 1799. No estate tax or.

All Extras are Included. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires.

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

North Carolina Tax Reform North Carolina Tax Competitiveness

Flexjobs Remote Work Virtual Job Fair Reserve Your Spot Virtual Jobs Job Fair Work From Home Jobs

Tax Administration Duplin County Nc Duplin County Nc

A Guide To North Carolina Inheritance Laws

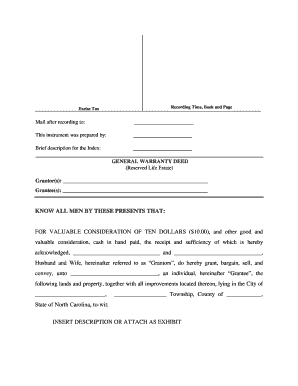

Life Estate Deed Fill Out And Sign Printable Pdf Template Signnow

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Special Proceedings To Sell Real Property Hopler Wilms Hanna

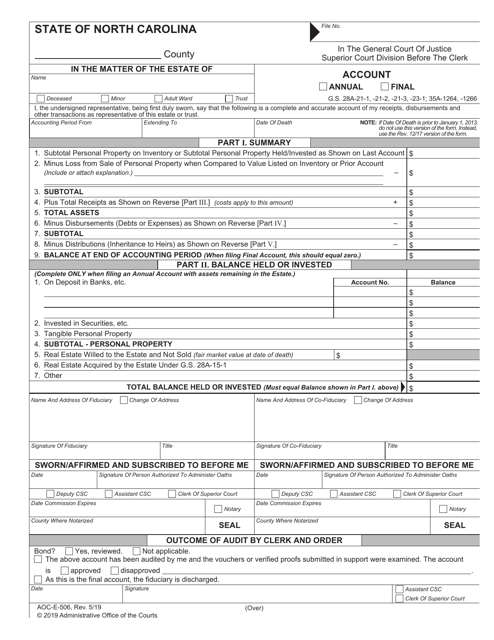

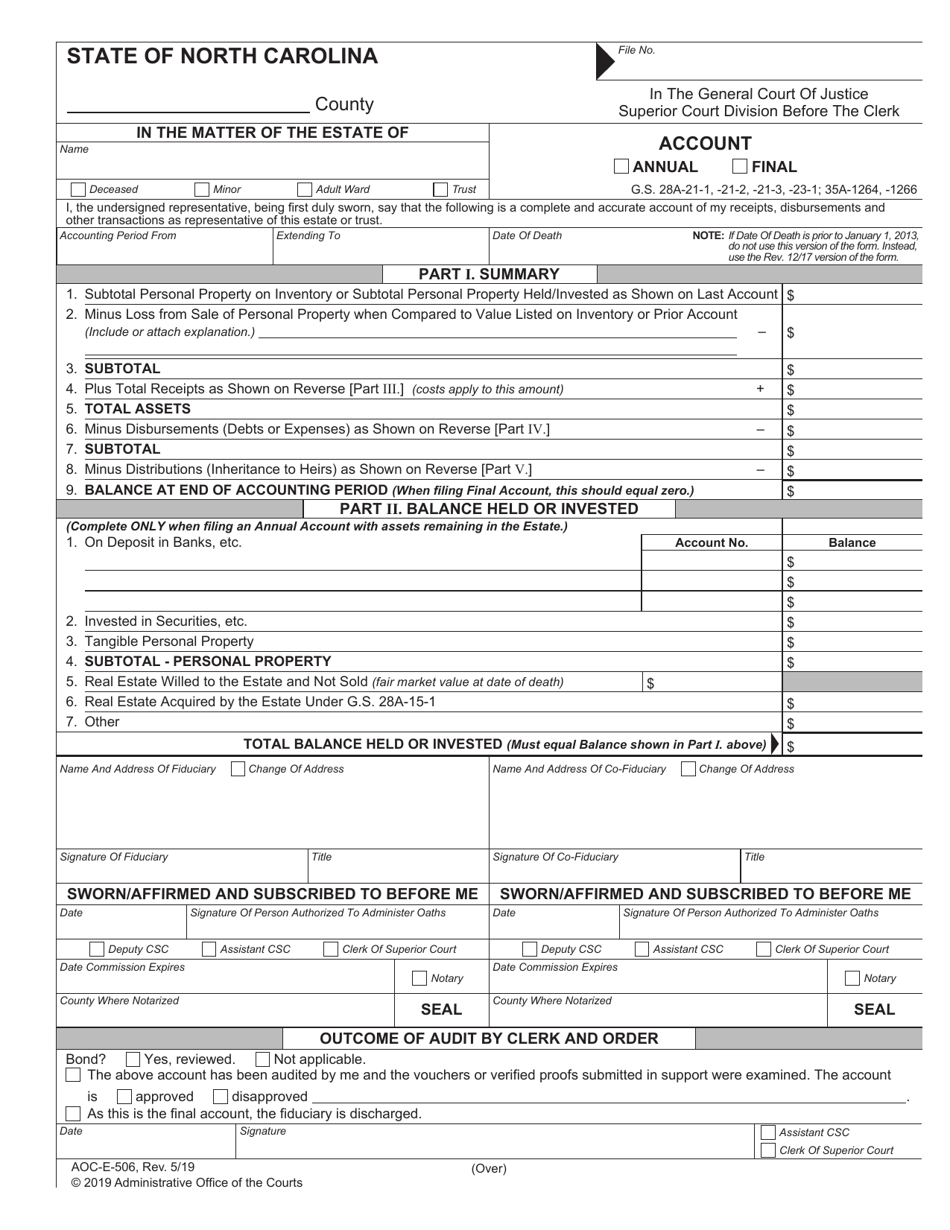

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Tax Reform North Carolina Tax Competitiveness

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Highlights Of North Carolina S Tax Changes

Tax Administration Duplin County Nc Duplin County Nc

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

135 Stillwater Rd Troutman Nc 28166 Realtor Com

Thank You For The Outstanding Service Going Above And Beyond This Company Was And Still Is A Fantast Above And Beyond Customer Experience Santa Clara County

Frequently Asked Questions Carolina Tax Trusts Estates

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset